Town council has passed the 2025 Tax Rate Bylaw with no increase to the municipal portion of property taxes, keeping rates at 2024 levels for both residential and commercial properties.

The bylaw was adopted during council’s regular meeting on May 7.

“We know that many residents and business owners are feeling the strain of higher costs across the board,” says Mayor Nancy Dodds. “We’ve worked hard to present a fiscally responsible and forward-looking budget that supports the services our community relies on while considering our future needs.”

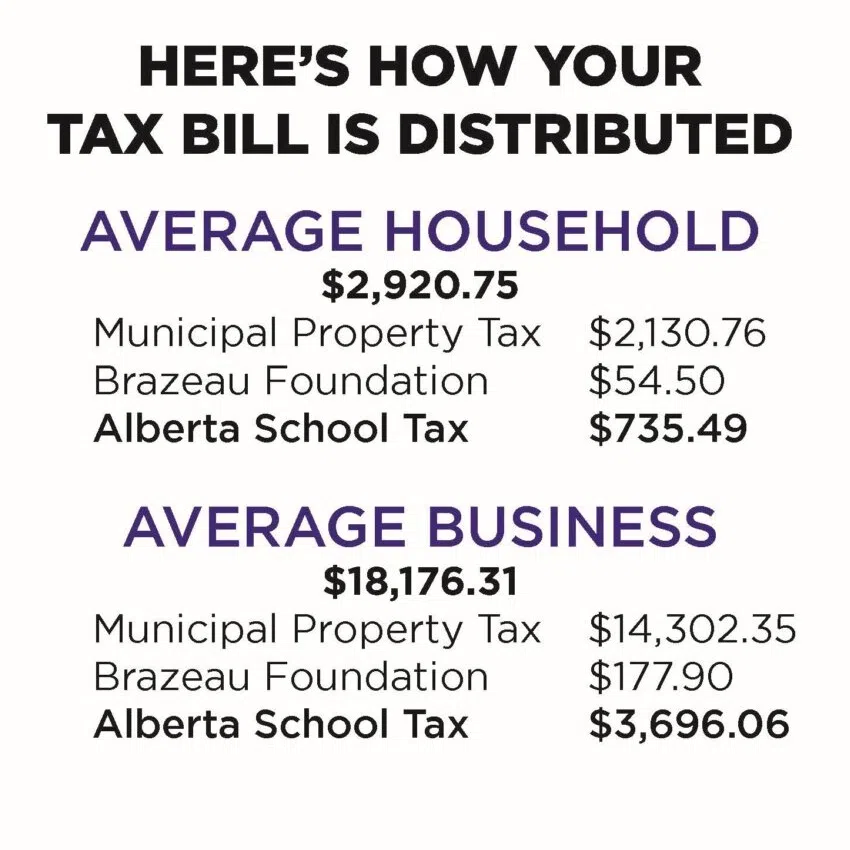

Despite the municipal rate freeze, property owners will likely see an increase in their overall tax bill due to assessment growth and a 12.91 per cent hike to the provincial education tax, which the town is required by law to collect on behalf of the Government of Alberta.

–

RELATED

–

Interim CAO Pat Vincent said cost savings on insurance, along with increased revenues from franchise fees and interest, have helped council deliver a balanced budget without raising taxes.

“Council’s direction and administration’s diligence have allowed us to maintain tax rate stability while still addressing cost pressures and making key investments that support operational effectiveness and community well-being,” said Vincent.

Property tax distribution for the average assessed residential household in Drayton Valley. (Town of Drayton Valley)

Officials say this year’s budget prioritizes customer service, community safety, infrastructure improvements and beautification projects, while maintaining current service levels and adding to municipal reserves.

“We are proud to deliver a budget that reflects responsible budgeting and long-term financial sustainability,” said Dodds. “It’s about balancing today’s needs while preparing for tomorrow’s opportunities.”

More information is available at draytonvalley.ca.

Comments